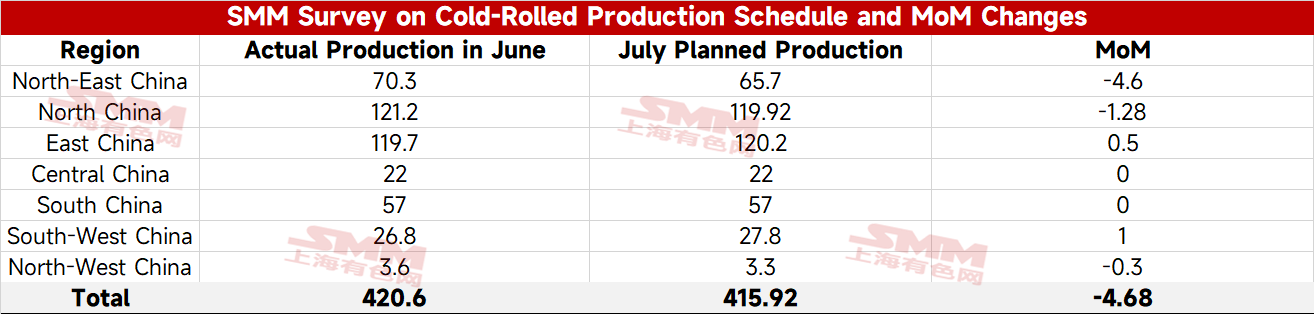

- SMM Cold-rolled Production Schedule: Cold-rolled Production Schedule of Steel Mills Declines Slightly in July

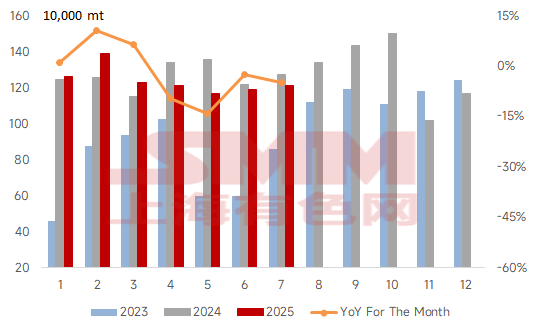

According to the latest tracking by SMM, the planned production volume of cold-rolled commercial materials for July from 31 mainstream steel mills producing cold-rolled sheets and coils totaled 4.1592 million mt, a decrease of 46,800 mt compared to the actual production volume of cold-rolled commercial materials in June, representing a decline of 1.11%. On a daily average basis, July has one more day than June, and the planned daily average production volume of cold-rolled materials in July was 134,200 mt, down 4.30% from the actual daily average production volume in June.

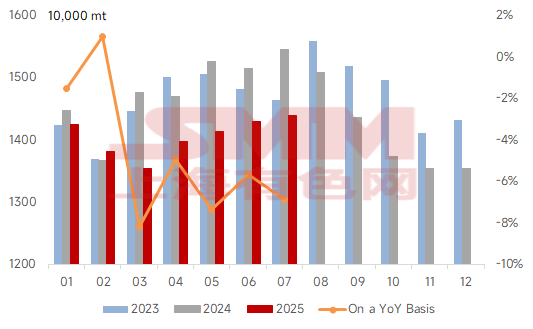

- SMM HRC Production Schedule: The daily average HRC production schedule decreased by 2.7%

According to SMM's latest tracking, the planned production volume of HRC commodity materials for July from 39 mainstream steel mills producing HRC totaled 14.3906 million mt, an increase of 74,900 mt compared to the actual production volume of HRC commodity materials in June, representing a growth rate of 0.52%. On a daily average basis, July has one more day than June. The planned daily average production volume of HRC commodity materials for July was 464,200 mt/day, a decrease of 13,000 mt compared to the actual daily average production volume of HRC commodity materials in June, representing a decrease rate of 2.72%.

In July, some steel mills in north and south China concluded their maintenance and gradually resumed production. However, as the impact of the off-season gradually emerged, downstream industry orders faced increasing pressure. Additionally, some steel mills in north China underwent annual maintenance. As a result, the total hot-rolled production schedule of steel mills in July remained basically stable MoM, while the daily average production schedule declined WoW.

Domestic trade: The production schedule for HRC in domestic trade in July was 13.1806 million mt, with a daily average production of 425,200 mt. On a MoM basis, the actual daily average production in domestic trade in June decreased by 15,400 mt, representing a decline of 3.50%.

Foreign trade: The planned HRC exports for July are 1.21 million mt, an increase of 112,200 mt compared to the actual exports in June, representing a MoM increase of 10.22%. The planned HRC exports for domestic steel mills in July increased slightly compared to the actual exports in June on a MoM basis.

Summary: The planned daily average production of hot-rolled coil (HRC) by domestic steel mills in July decreased MoM compared to the actual production in June. This was partly due to annual maintenance at some northern steel mills and partly due to the intensified impact of the off-season, with some steel mills reporting increased difficulty in taking orders, leading to corresponding adjustments in their production schedules.

Looking ahead, in terms of supply, the daily average production schedule of HRC by steel mills in July decreased slightly MoM, which will alleviate inventory pressure in the spot market to a certain extent. In terms of demand, against the backdrop of the off-season, with frequent high-temperature and rainy weather, the overall demand for steel is under pressure. However, the downstream demand for HRC and steel exports are expected to maintain strong resilience.

Additionally, on the macro front, at the beginning of July, the central government once again emphasized promoting the orderly exit of backward production capacity, regulating enterprises' low-price and disorderly competition in accordance with laws and regulations, and rectifying "anti-cut-throat competition," which instantly sparked a wave of enthusiasm, driving up the prices of the ferrous metals series. Against the backdrop of the "anti-cut-throat competition" policy and the "warm breeze" of the Political Bureau meeting, market sentiment has recovered. It is expected that the average price of HRC in July will rise slightly. However, the overall pullback in steel demand during the off-season will limit the upside room for HRC prices.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)